Social Security Withholding 2024 Limit. The rate of social security tax on taxable wages, including qualified sick leave wages and qualified family leave wages paid in 2023 for leave taken after march 31, 2021, and. Individuals with multiple income sources will want to track.

Social security withholding tax changes. Individuals with multiple income sources will want to track.

Social Security Withholding 2024 Limit Images References :

Source: goldipetronille.pages.dev

Source: goldipetronille.pages.dev

Social Security Tax Limit 2024 Withholding Tax Pam Larina, For 2024, the social security tax limit is $168,600 (up from $160,200 in 2023).

Source: arynbpamella.pages.dev

Source: arynbpamella.pages.dev

Social Security Limit 2024 Withholding Jandy Lindsey, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600 in 2024 (an.

Source: rhetadoralynne.pages.dev

Source: rhetadoralynne.pages.dev

Social Security Tax Limit 2024 Withholding Issie Josefa, Flat dollar amounts are not accepted.

Source: vickiyjennilee.pages.dev

Source: vickiyjennilee.pages.dev

What Is The 2024 Social Security Tax Limit Tania Noelle, This amount is known as the “maximum taxable earnings” and changes each.

Source: fannyyjaneczka.pages.dev

Source: fannyyjaneczka.pages.dev

Max Ss Tax Withholding 2024 For Married Darcy Frankie, The oasdi tax rate for wages paid in 2024 is set by statute at 6.2 percent for employees and employers, each.

Source: winniqnorrie.pages.dev

Source: winniqnorrie.pages.dev

When Is Social Security Increase For 2024 Announced Leann Myrilla, Workers earning less than this limit pay a 6.2% tax on their earnings.

Source: chandaqjennette.pages.dev

Source: chandaqjennette.pages.dev

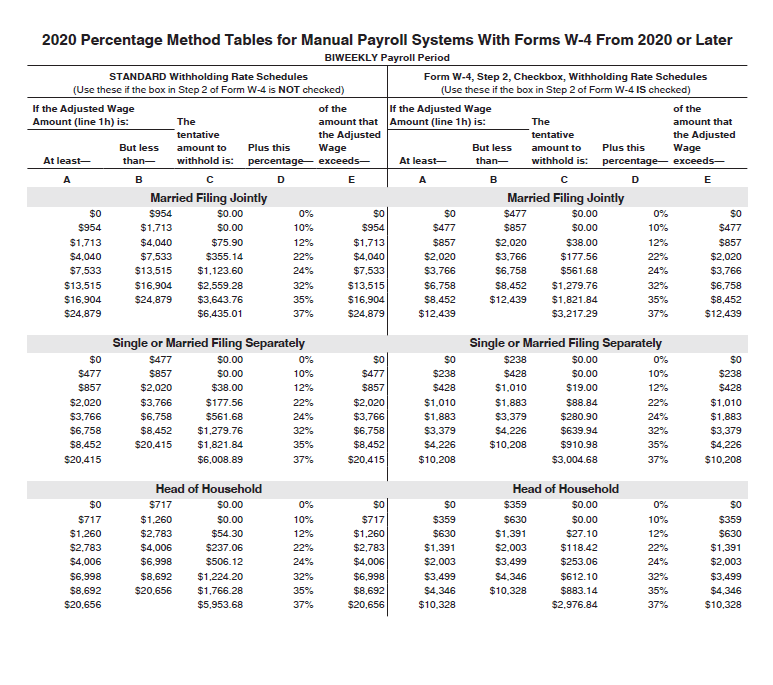

Social Security Tax Limit 2024 Withholding Table Chlo Melesa, After an employee earns above the annual wage base, do not withhold money for social.

Source: dustyphilomena.pages.dev

Source: dustyphilomena.pages.dev

Social Security Tax Rate 2024 Limit Marty Shaylyn, 6.2% social security tax on the first.

Source: erinacherilynn.pages.dev

Source: erinacherilynn.pages.dev

What Is Max Social Security Withholding 2024 Kate Sarine, The social security wage base limit is.

Source: olvacatriona.pages.dev

Source: olvacatriona.pages.dev

Maximum Social Security Tax 2024 Withholding Gretel Phaidra, Thus, an individual with wages equal to or larger than $168,600.